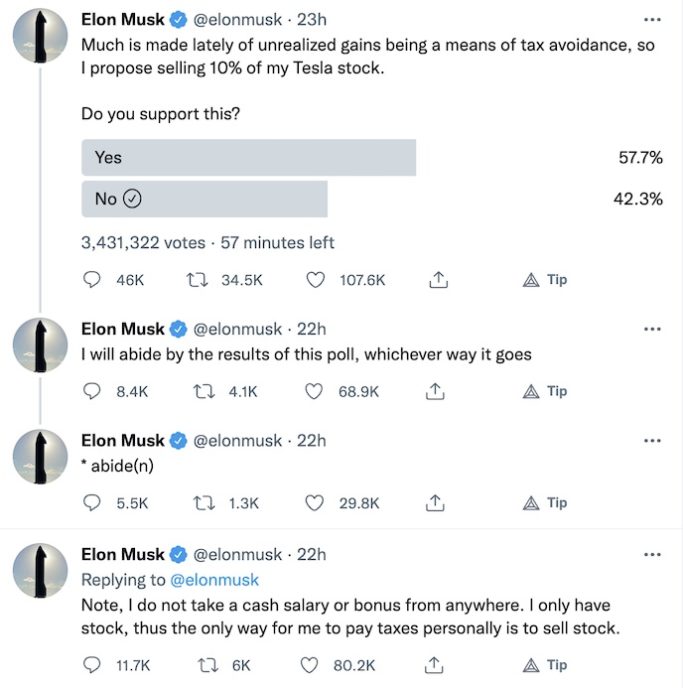

The internet and markets are a buzzed with news that Elon Musk may sell 10% of his Tesla holdings. On Friday night, Elon asked his 62.7 million Twitter followers whether he should sell 10% of his Tesla stocks.

He said he will abide by the results of poll, whichever way it goes, and it looks like his followers want him to sell. The thing is, even if the poll were to vote no, Elon would end up selling anyways.

Elon Is Facing a $15 Billion Tax Bill

A look at Tesla’s SEC filings reveal that Elon was awarded options in 2012 as part of his stock based compensation package. Because he doesn’t take a salary or cash bonus, his wealth comes from stock awards and the gains in Tesla’s share price.

The 2012 award was for 22.8 million shares of Tesla at a strike price of $6.24 per share. Tesla shares closed at $1,222.09 on Friday, meaning his gain on the shares totals just under $28 billion.

At the Code conference in September, Elon said, “I have a bunch of options that are expiring early next year, so a huge block of options will sell in Q4 because I have to or they’ll expire.”

The options will expire in August 2022. In order to exercise them, Musk has to pay the income tax on the gain. Stock options are taxed as ordinary-income, meaning Elon will pay 37% plus the 3.8% net investment tax. He will also have to pay the 13.3% top tax rate in California since the options were granted and mostly earned while he live the golden state.

Combined, the state and federal tax rate will be 54.1%. So the total tax bill on his options, at the current price, would be $15 billion.

Selling 10% of his Tesla holdings would give Elon about $21 billion. Minus the $15 billion option tax bill and $4.2 billion capital gains tax on the sale, and he’ll be left with around $1.8. billion, which should be enough to pay off his line of credit. Then he’ll be cash poor again.