When looking at Apple’s 2021 income statement, you’ll notice they spend a lot of money to run their business. The company spent $22 billion on research and development and another $22 billion for selling, general and administrative expenses. However, there is one item that makes everything else look like peanuts. At $85.5 billion, this is Apple’s single biggest expenditure.

Buying Back Its Own Stock

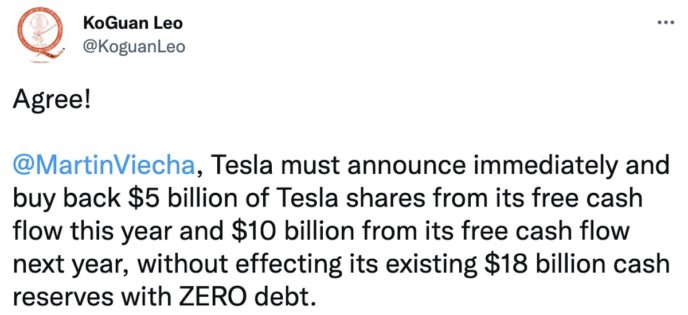

Apple spends more money buying back its own stock than on anything else. With the stock market in a downturn, more and more companies are doing stock buybacks. Google announced a $70 billion share buyback program during their Q1 earnings call, Berkshire Hathaway have been buying back their stock at an average rate of $100 million per trading day, and billionaire Tesla shareholder Leo KoGuan is calling on Tesla to announce a $15 billion share buyback immediately.

What Is a Share Buyback and Why Are So Many Companies Doing It?

A share buyback is one of two elements (dividends being the other) in what is known as a Capital Return Program. In a nutshell, the company would buy its own shares from the open market to remove those shares from the market. To understand why a company would do this, you need to understand how the share price of a company is determined.

EPS and PE Ratio

The price of a stock is determined by two numbers. Earnings Per Share (EPS) and the Price Earnings Ratio (PE). EPS is calculated by taking the companies earnings and dividing it by the number of outstanding shares in the market. If a company earned $1 million and has 1 million shares outstanding, then EPS is $1. The PE Ratio is how much an investor is willing to pay for a dollar of earnings. If the stock was trading at $30, then the PE ratio would be 30.

A companies doesn’t have much control over its PE Ratio, but it has direct control over EPS. Because of this, there are two ways to increase stock price. Most companies try to do this by increasing earnings. In my example, going from $1 million earnings to $2 million will increase EPS to $2, which will increase the share price to $60 if the PE ratio remained the same.

The other way to increase the stock price is by reducing the number of outstanding share. If our 1 million share company were to buy back 500K shares it would leave only 500K outstanding shares. EPS would suddenly increased $2 per share ($1 million / 500K shares) and the stock price would go to $60 if the PE ratio remained the same.

In the case of Apple, they do both. Company earnings have increased from $55 billion in 2019 to almost $95 billion in 2021. During the same three year period, Apple bought back over $225 billion of its own stock, spending $85.5 billion in 2021. Apple plans to increase the buyback to $90 billion in 2022.

The Positive and Negative of Share Buybacks

Stock buyback generally only benefit shareholders of the company. Unlike being paid a dividend, a company buying back its own shares doesn’t trigger any tax event, and that’s one of the reasons investors like them.

The negative of share buyback is they only benefit shareholders and no one else. No matter how slice it, Apple spending $225 billion over three years to buy back its stock is a crazy amount of money to spend on just one group of people.

With the economy heading into a recessing and the stock market trending down, companies that are flushed with cash, like Apple, will be eyeing buying back their own stock as their best use of their money. In the case of Apple, it’s their biggest single expenditure of cash.