This post will help illustrate the power of the home equity line of credit and systematic withdrawal plan (SWP) strategy. Bob has a fully paid for house – its current value is $400,000. After reading my blog, Bob decides that having all his assets tied up in his house is not the smartest thing to do so he goes to his bank and gets a $300,000 home equity line of credit and invests the proceeds in equity index funds. At the same time he set ups a systematic withdrawal plan to pay the monthly interest cost.

Before we continue, let’s make a few assumptions – interest on the line of credit is at prime, which is currently 6%. The index funds perform at 10% per year. That is the average return the TSX index has produced in the past 50 years. Yes there were years when the returns were less than 10% (or negative) and there were years when the returns were well above 10%. But the overall average for the past 50 years is 10%. If you are going to do this strategy, you must be willing to go at least 5 years to ride out any market downturn.

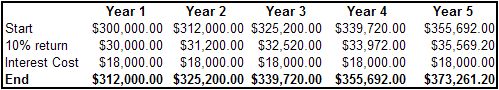

Let’s say it’s 5 years later. Bob looks at his portfolio to check out how it’s doing. This is what his portfolio will look like.

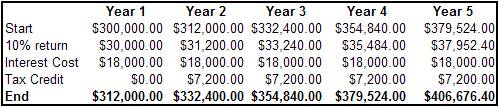

Even though Bob had $18,000 taken out of the funds every year to pay the interest on the line of credit, the ending balance of his funds after 5 years is up over $70,000. In addition to that, Bob has been getting huge tax refunds every year because he was able to deduct the interest on the line of credit, which was paid by the SWP and not him. If Bob was in the 40% tax bracket he would get back $7,200 each year that he can use to buy more index funds. Then the numbers would look like this.

In five years Bob has been able to increase his assets outside of his home by over $100,000 and not a single penny came from his pocket. The longer Bob keeps this going, the better the numbers become. If Bobs goes for another 5 years, the value of the funds would increase to nearly $590,000. This is the power of compound interest. The longer you leave it in, the more you will make. In 20 years, the funds will be worth nearly $1.36 million. If Bob closed out the investment at that time, he would repay the $300,000 to the line of credit and have $1.06 million left over, plus a free and clear house. A pretty good way to retire, huh? Much better than just a clear title house and no money.

The beauty of this strategy is absolutely no money comes from your pocket. You are leveraging the equity in your home to make you money. To match Bob’s investment return of $1.06 million in 20 years with normal out of your pocket investing, you would need to invest $16,800 every year for the next 20 years (assuming the same 10% return). How many people can sock away $16K a year into investments? Yet, this strategy allows you to get the same results without ever having to reach into your wallet. If you have a lot of equity in your house, it’s time to put it to work and turn your home into a money train!

As always, please consult a qualified financial planner before proceeding with any strategies I give on this blog.